Rental markets’ pandemic recovery stronger than predicted

MEWP rental markets have recovered better than was predicted to be the case in 2020, with most countries seeing markets and wider economies on course to recover to 2019 levels by the end of this year or early in 2022, according to the latest analysis, conducted for the International Powered Access Federation (IPAF) by Ducker.

Overall, most markets in Europe, the US and the Middle East have recovered more quickly than was forecast in the 2020 rental reports, though fears of a fifth wave of Covid-19 and accompanying lockdowns and restrictions in some western European countries may temper optimism as we approach the end of 2021.

The newly published Global Powered Access Rental Market Report 2021 shows that the pandemic has not left permanent scarring or caused companies to shed staff and reduce fleet size; rather that most consolidated and shelved investment with a view to scaling up operations in line with rebounding demand, restoring utilisation rates (which had fallen to just 58% on average for the ten European countries under study at the end of 2020), while keeping rental rates stable and planning for modest growth in 2022.

Most companies responding to Ducker’s survey planned to resume investment in fleet expansion and green power sources in 2022 and beyond, and nearly all countries had seen a rebound in activity that had all but cancelled out the effects of the pandemic and successive lockdowns by the end of 2021. While the overall drop in revenue was less drastic than expected and forecasted in last year’s report, European markets were still hit hard by the pandemic.

The report indicates that Denmark (0%) Sweden (-2%) and Germany (-4%) suffered the smallest hit to overall rental revenue during 2020, owing to their respective approaches to the pandemic, which were either short sharp lockdowns or no enforced national lockdown at all, in Sweden’s case. On the other hand, Spain (-13%), Italy and France (both -12%), along with the UK (-10%) all suffered double-digit contractions in overall rental market revenue across 2020. Together, European countries under study contracted by an average of 8%, compared to a 7% contraction in the US.

Germany crept ahead of France and the UK to stand at the end of 2020 as the country in Europe with the largest MEWP fleet, with the UK, in particular, seeing slight defleeting during the peak part of the pandemic; all have fleets of just under 60,000 units. France is predicted to increase fleet size in 2021 and could once again re-establish itself as the

country in Europe with the largest fleet. The overall shift towards greener power sources has not been significantly derailed by the pandemic, though much investment was put on hold in 2020-21.

Only the UK (-2%) and Netherlands (-1%) saw overall fleet size shrink during 2020, with mostly older or more specialist machines sold into the used equipment market. This allowed both countries to mitigate a fall-off in utilisation rate.

Spain (-14%), Italy (-13%) and France (-12%) were among those worst hit in Europe when it comes to revenue per unit, owing to the impact of the pandemic and sustained national lockdowns, coupled with other underlying factors contributing to economic uncertainty, including the ongoing impacts of Brexit on Anglo-European relations. Spain and Italy also both maintained modest fleet expansion across 2020 as a whole, helping suppress overall utilisation rate and revenue per unit. France, Spain, the Netherlands and Germany all saw an overall drop in rental rates of between 2% and 7%.

After being stable for three years up to and including 2019, the average retention period in Europe dropped slightly owing to the defleeting in some rental companies and an increase in the market value of used machines owing to increased prices and lead times from OEMs in late 2020, a trend that continues in 2021.

Overall, outlooks for 2021 saw those countries that were hit hardest during 2020 rebound most strongly, as construction and wider society opened up and economic recovery was sustained.

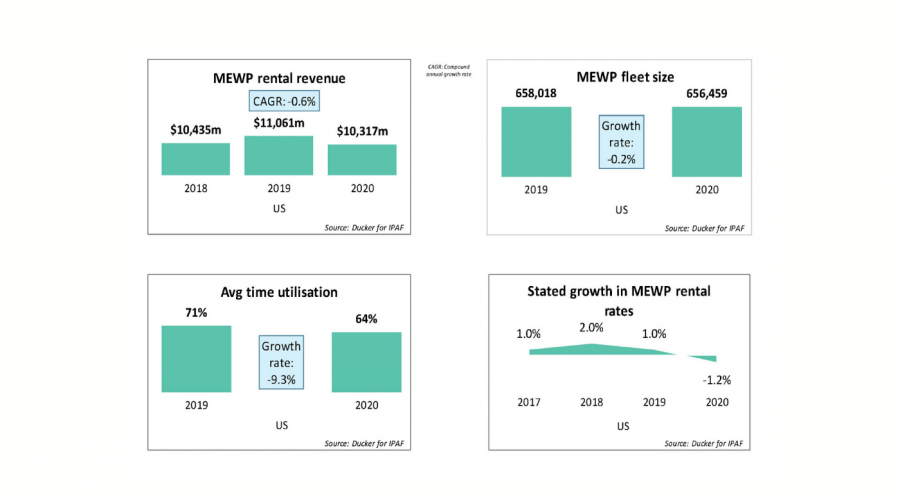

In the US, despite overall optimism at the end of 2019 with a change in presidency and some investment in the early months of 2020, companies drastically reduced their spending on new machines in 2020 once the pandemic took hold, leading to a static fleet size across the year, at just over 650,000 units.

As in the UK and Netherlands, some companies discarded some of their older or less versatile machines to maintain profitability levels, these usually being sold on to other rental companies as used equipment, which in turn allowed small to medium-sized companies to save money on buying new machines or allowing them to meet specific customer demand in terms of volumes or machine specialisms. Investment fell across 2020 by around 67% during and is forecast to have recovered 45% by the end of 2021. Utilisation rate slumped to 64% during 2020 but is forecast to recover to and indeed exceed the average pre-pandemic rate in the US to stand at around 74% at end 2021.

As in 2020, the report also contains a special market focus on China and adds a report focusing on the Middle East Gulf Co-operation Council (GCC) countries of Saudi Arabia, UAE and Qatar. The China report paints a picture of a MEWP rental market still growing at unprecedented speed, only marginally impacted by the coronavirus pandemic, and set to keep surging in terms of fleet size and market penetration.

Overall utilisation rate decreased slightly, while rental rates dropped significantly in China across 2020, but total fleet size continued to rise, forecast to increase from just over 200,000 units at the end of 2020 to around 300,000 at the end of this year.

This expansion is also reflected in the continued rise in rental revenue, up from €703m at end 2019 to €974m in 2020 and forecast to exceed €1.15bn by the end of 2021. Despite this phenomenal expansion, the Chinese MEWP rental market has much

capacity for growth and is far from saturated. Rental companies expect to keep expanding fleets in the next few years, and the total volume of rental units is anticipated to keep increasing at rates in excess of 20% annual growth.

The picture is a little more mixed in the Middle East, and much more aligned with the market situation in Europe. As with pretty much everywhere in the world, most Middle Eastern countries were significantly impacted by the pandemic, seeing a drastic drop in revenue between 2019 and 2020, owing largely to the postponement of major construction projects. The fall in revenue was a product of slides in average utilisation rate, fleet size and rental rates, which all decreased significantly owing to end use demand falling during the peak months of the pandemic. The report indicates that in 2021 the 14% fall in rental revenue will recover by around 9% to leave the overall market 5% down on the 2019 year-end position.

The pandemic saw utilisation rates fall from 2019’s level of 75% to just 65% in 2020, and this is expected to recover to around 70% by the end of 2021, leaving the metric much more in line with what is the pre-pandemic norm in most European countries and the US.

As in Europe and the US, investment is expected to recover after an 86% drop-off in 2020 – investment in 2021 remains below where it might have been expected to be had the pandemic not happened in Saudi Arabia but is growing slightly more vigorously in UAE and Qatar, as catch-up on delayed construction projects including the Expo 2020 world’s fair in the UAE and the FIFA World Cup 2022 in Qatar has reinvigorated demand.

● For a detailed analysis of European, US, Chinese and Middle Eastern markets, the 2021 and 2020 IPAF Global Powered Access Rental Market reports are available to buy now at www.ipaf.org/reports; a generous discount on purchase prices is available to IPAF members. The 2020 report is also available to purchase, while reports from 2019 and older are now free to view/download. Click to view a free webinar based on highlighted findings from the 2021 report.